Peru’s latest political scandal has put the country’s deep economic embrace of China under unprecedented strain. The affair, centred on secret meetings between Peru’s acting president and a Chinese businessman, is fuelling a broader debate over how Beijing is exploiting weak institutions in the region.

Reuters reports that the controversy erupted after revelations that acting President Jose Jeri held a series of undisclosed meetings with Chinese entrepreneur Zhihua Yang between December and January, encounters that never appeared on his official schedule. Local media quickly dubbed the affair “Chifagate,” and opposition lawmakers have launched impeachment moves against the 39‑year‑old leader, who is due to complete the current government’s term until July.

Prosecutors have opened a preliminary probe into whether Jeri improperly used his influence, allegations he has denied, while insisting that his talks with Yang were benign and related to the upcoming anniversary of Peru‑China diplomatic ties. In Congress, Jeri has acknowledged error in holding off‑agenda meetings and in doing so “in a concealed manner,” but he has rejected claims that he received “irregular” requests or favours from the businessman.

The scandal has drawn fresh attention to Yang’s role as a fixer and facilitator for Chinese firms chasing big contracts in one of the world’s top copper exporters. According to Reuters, Yang and his companies have been cited in investigations as providing logistical support to Chinese firms suspected of corruption, deepening concern that foreign money is amplifying Peru’s entrenched graft problem.

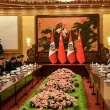

China’s corporate presence in Peru is extensive: Chinese companies operate one of the country’s largest copper mines and control key power plants, and they have poured billions of dollars into ports, mines, transport and energy. Beijing‑linked investors are also behind the Chancay “megaport” on Peru’s Pacific coast, which opened operations in late 2024 and is billed as a new Silk Road‑style gateway connecting South America directly to Asia.

Those stakes mean the fallout from “Chifagate” reaches far beyond one presidency. A 2009 free trade agreement helped China overtake the United States as Peru’s top trading partner in 2015, and by November last year China accounted for roughly 33% of Peru’s trade, compared with 14% for the U.S., Reuters notes. China now buys about 70% of Peru’s copper exports, embedding itself in the fiscal lifeblood of an economy that, despite seven changes of president since 2018, has remained among Latin America’s fastest‑growing on the back of mining revenues.

Peru’s upcoming April 12 presidential election will offer the first clear gauge of how far “Chifagate” has damaged the political consensus behind close ties with Beijing. Whatever the outcome, the scandal has turned one of China’s most successful Latin American partnerships into a test case for how resilient South–South economic integration can be under the glare of U.S. scrutiny and rising public anger over corruption.